Federal tax estimator 2020

It is mainly intended for residents of the US. Use your income filing status deductions credits to accurately estimate the taxes.

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

January 15 of the following year.

. The calculator will calculate tax on your taxable income only. You can use the worksheet in Form 1040-ES to figure your estimated tax. THE DEADLINE PASSED BUT WE CAN STILL.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. You can use the Tax Withholding. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

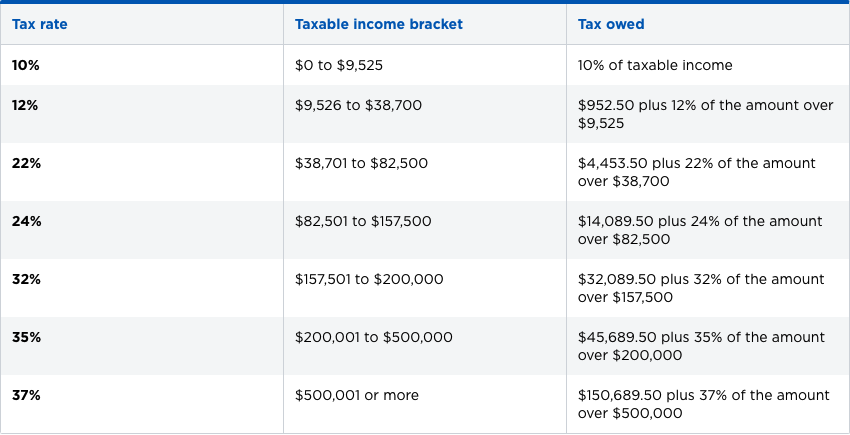

Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. Find Everything You Need To Quickly Finish Your Past Years Taxes. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. For help with your withholding you may use the Tax Withholding Estimator. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

Jacksons Tools Are Designed To Help Guide Your Clients Each Step Of The Way. Ad Search For Info About Estimate income tax calculator. See January payment in Chapter 2 of Publication 505 Tax Withholding and Estimated Tax.

19 hours agoFederal student loan borrowers who earned less than 125000 in either the 2020 or 2021 tax years are eligible. September 1 December 31. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

And is based on the tax brackets of 2021. Ad You Can Do It. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

Your household income location filing status and number of personal. For those who filed taxes jointly or as a head of household the. Browse Get Results Instantly.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Americas 1 tax preparation provider.

Ad Take Advantage Of Resources For Jackson-Appointed Financial Professionals. Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator. Estimate your tax refund with HR Blocks free income tax calculator.

2020 Simple Federal Tax Calculator. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. See how income withholdings deductions and credits impact your tax refund or balance due.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Liberty Tax Service tax estimator can help you quickly and easily estimate your federal tax refund by following a few simple steps online.

Your household income location filing status and number of personal. 1 online tax filing solution. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

You need to estimate the amount of income you expect to earn for. Enter your filing status income deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year we can also estimate your tax refund or.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 2020 Federal Income Tax Brackets and Rates. The information you give your employer on Form W4.

Use your prior years federal tax return as a guide. Based on your projected tax withholding for.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Federal Income Tax

Hmrc Sa302 Tax Calculation Templates Document Templates Bills

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

Income Tax Calculation Fy 2019 20 Salaried Employees Standard Deduction Rebate U S 87a Cess Youtube Standard Deduction Income Tax Income

Income Tax Income Tax Income Tax

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Tax Refund Estimator Calculator For 2021 Return In 2022

Income Tax Mini Ready Reckoner 21e Income Tax Income Investing

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Income Tax Efiling In India Cleartax Upload Your Form 16 To E File Income Tax Returns Filing Taxes Tax Refund Income Tax Return

Federal Income Tax Brackets Brilliant Tax

Personal Income Tax Slab For Fy 2020 21 Income Tax Income Tax Return Income

Irs Releases Second Draft Of 2020 Form W 4 Tax Withholding Estimator Check Out The Latest Updates To 2020 Form W 4 The Irs I Irs Federal Income Tax Draught